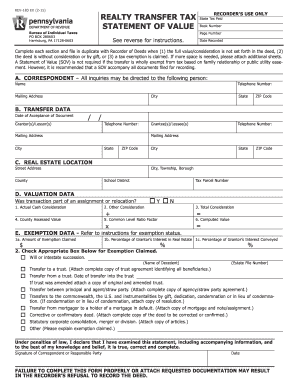

PA DoR REV-183 EX 2019-2024 free printable template

Get, Create, Make and Sign

Editing pennsylvania tax value online

PA DoR REV-183 EX Form Versions

How to fill out pennsylvania tax value 2019-2024

How to fill out realty transfer tax:

Who needs realty transfer tax:

Video instructions and help with filling out and completing pennsylvania tax value

Instructions and Help about transfer tax pa form

In our Institute we celebrate the miraculous medal our lily appeared to see Catherine love away in 1830 and asked her to how this metal struggle and so hard so we celebrate that as East and we can understand why we would do that we understand exactly what the medal was called in it originally was not involve Americans medal it was called the medal of the Immaculate Conception and we was actually our lady made that request to st. Catherine some 24 years before the dogma was defined but she was already negating exactly what st. Maximilian would would come to promote something well nearly a hundred years later actually and that is that once the dogma is defined what is the next step that is to make it lived to live our lady's immaculate pneus that's what our Lord was telling us where when else are in the gospel he tells us to be perfect as your heavenly Father was perfect we must be immaculate after I let it live not immaculate this wrist we seek her intercession and she offers it and that's what we see in the gospel passage we just heard vakidis our Lord works his first miracle mr. st. John calls signs his signs the sign of his divinity and that he is here to care for us he is here for us the first of his signs this is the wedding feast of Cana and it was operated at the direct request or bus a motherly at her intercession and that is exactly this is work how it come to be known as their miraculous medal how many because of the numerous miracles that have been worked by this medal by the proper the faithful use of this medal and praying the prayer Oh Mary conceived without sin pray for us who have recourse to eat now you haven't won praise exactly what I have just been compounding here the fact that she is the Immaculate Conception and secondly that she's interceding for us and we're asking that intercession and she does so very powerfully and she has many many times so many then it became to be known as Americans medal and we can also reflect a little bit on the symbols on the medal in the front up front he actually see our lady with her arms extended out towards the globe and the Rays coming from her hands it seems to me if I remember correctly and originally it was she was actually holding up the globe but this is how it came to be struck with her hands out and the raisin coming from her hands from the rings on her fingers extending towards the glow that image became milk became came to be known as our lady of grace which is one of the most popular images we have are blessedly but he or she is extending her motherly intercession to all of us who's also she's needed tricks of all graces and she told st. Catherine those rays that you see coming from my fingers the rings on my fingers are the graces i bestow on the world the nelson cath had also noted there are rings there with nothing coming from and she asked our liver what are those said those are the graces I have to bestow that nobody asks for once again pointing back to the fact that God...

Fill pa form rev 183 : Try Risk Free

People Also Ask about pennsylvania tax value

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your pennsylvania tax value 2019-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.